Company Structures: Types & How to Choose in Malaysia

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Instant Job Ads.

Hire NowIf you’re registering a new business or thinking of restructuring your company, you might feel overwhelmed by terms like Sdn Bhd, LLP, or Sole Proprietorship.

Each structure comes with different legal, financial, and operational responsibilities.

Picking the wrong one can lead to more paperwork, limited growth, or unexpected costs.

In this article, we’ll break down the main types of company structures in Malaysia to help you decide which one fits your business goals.

What is a Company Structure?

Running a business is not just about having a great idea or building a strong team.

As your company grows, how you organise the team becomes just as important. This is where a company structure comes into play.

A company structure refers to the legal and operational setup that defines how your business runs.

It affects everything from your responsibilities as an employer to how decisions are made, how taxes are handled, and how much control you have.

It is like the blueprint of a house. You can’t just throw furniture around and expect things to work.

You need walls, rooms, and doors so that everyone knows where they belong and how they can move around.

A good structure gives clarity. It tells your employees who they report to, what their responsibilities are, and how they fit into the bigger picture.

It also helps you manage operations better, avoid conflicts, and focus on business goals.

Choosing the right company structure is especially important because it also decides your compliance level, legal protection, and even your access to funding.

Before you register your business, or if you’re thinking about restructuring, take time to understand the different types of company structures available.

Each comes with its own set of rules, benefits, and challenges.

Types of Company Structures in Malaysia

When you're starting a business or thinking about restructuring, choosing the right company structure is one of the most important decisions.

There are several types to consider, each with different rules, responsibilities, and levels of risk.

Let’s walk through the most common types in Malaysia and how each one works from a business owner's point of view.

1. Sole Proprietorship

If you're starting small and running things on your own, a sole proprietorship might be the easiest option.

It's registered under your personal name or a trade name, and you're in full control.

But here's the catch. You are the business. There's no legal separation between you and your company.

That means if your business owes money or faces legal trouble, you're personally responsible.

This structure is great for side businesses, freelancers, or small retail owners. It's cheap to register and easy to manage.

However, as your operations grow or if you plan to bring in partners or investors, this structure can become a limitation.

2. Partnership

A partnership is like a shared version of a sole proprietorship. It’s when two or more people run a business together.

Each partner contributes to the business and shares profits and losses.

There are two main types in Malaysia:

-

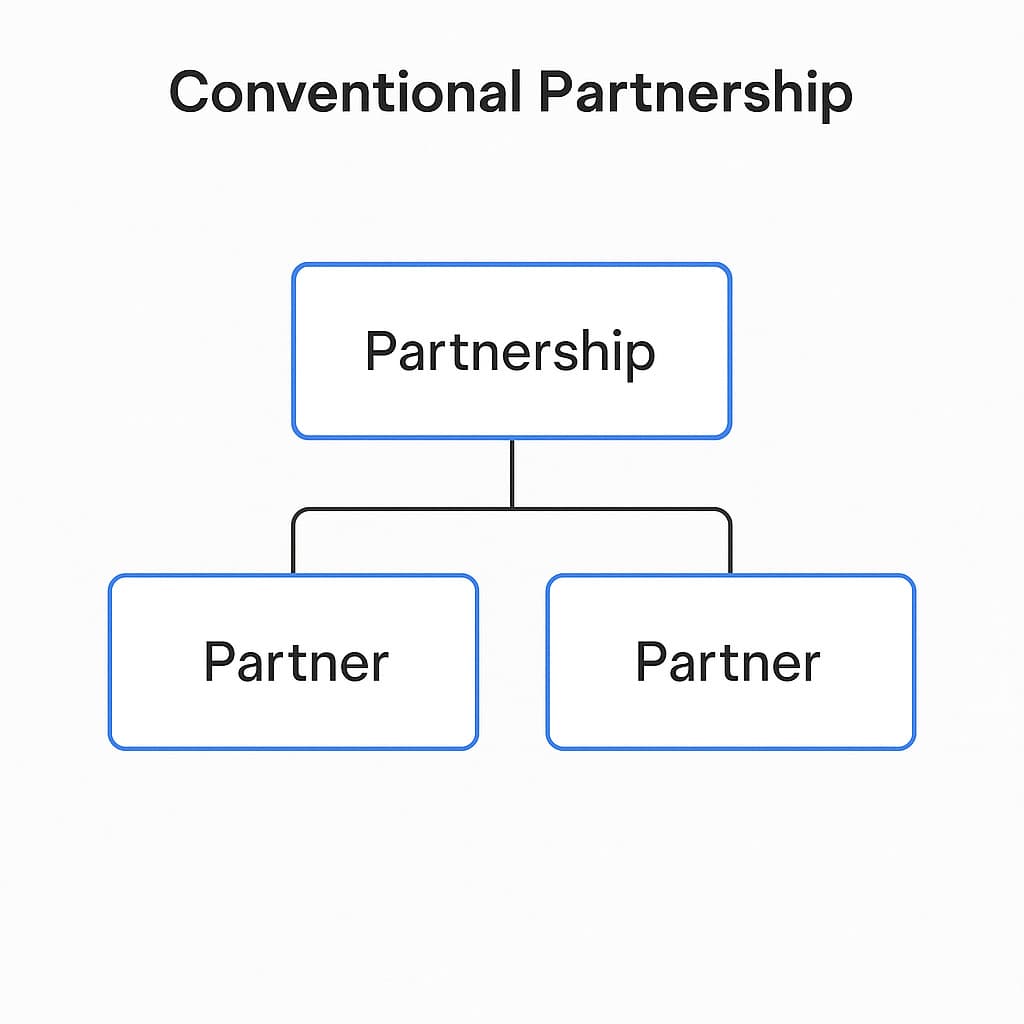

Conventional Partnership: All partners share equal responsibility, which also means shared liability.

-

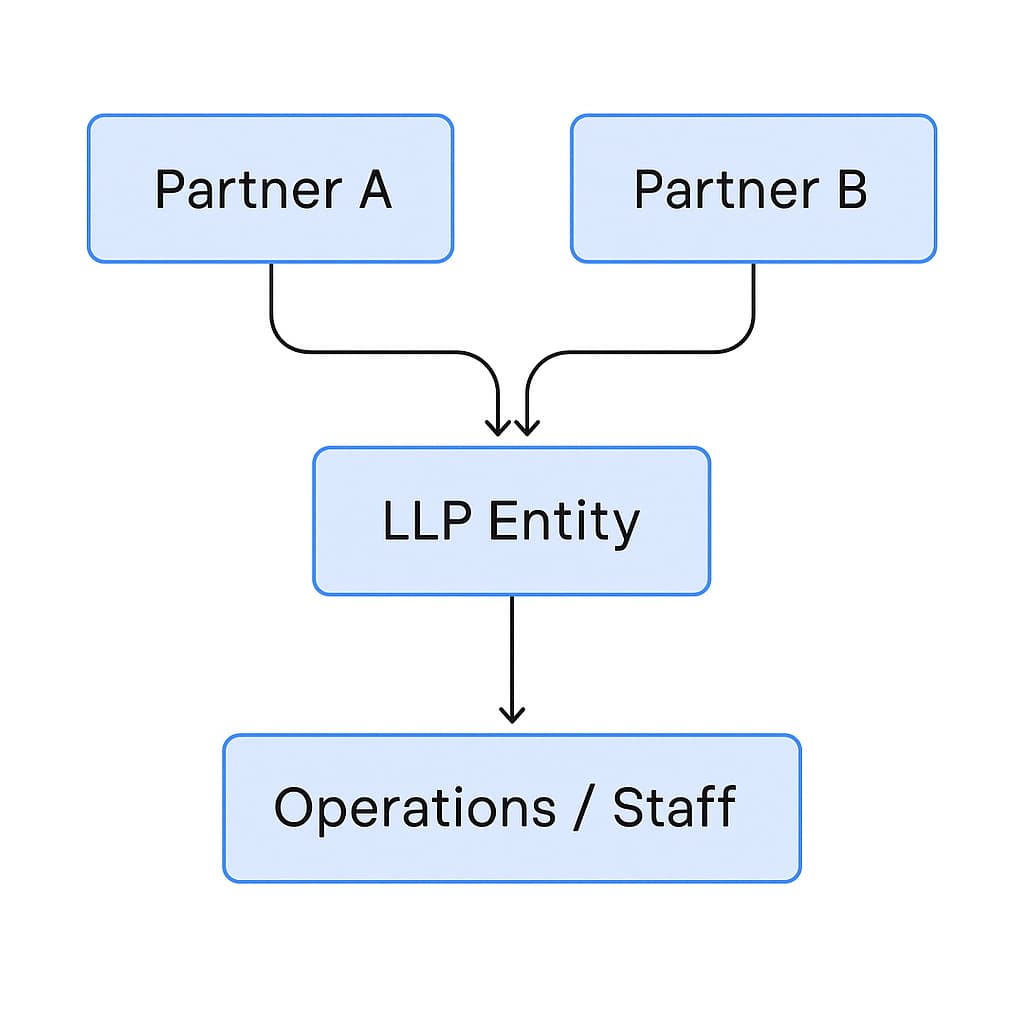

Limited Liability Partnership (LLP): This is more flexible. Partners are protected from each other’s mistakes, and it combines the simplicity of a partnership with some of the benefits of a company.

LLP is becoming more popular in Malaysia, especially for small professional firms like law, accounting, or consulting practices.

It’s useful when you want flexibility in management but still need some legal protection.

3. Private Limited Company (Sdn Bhd)

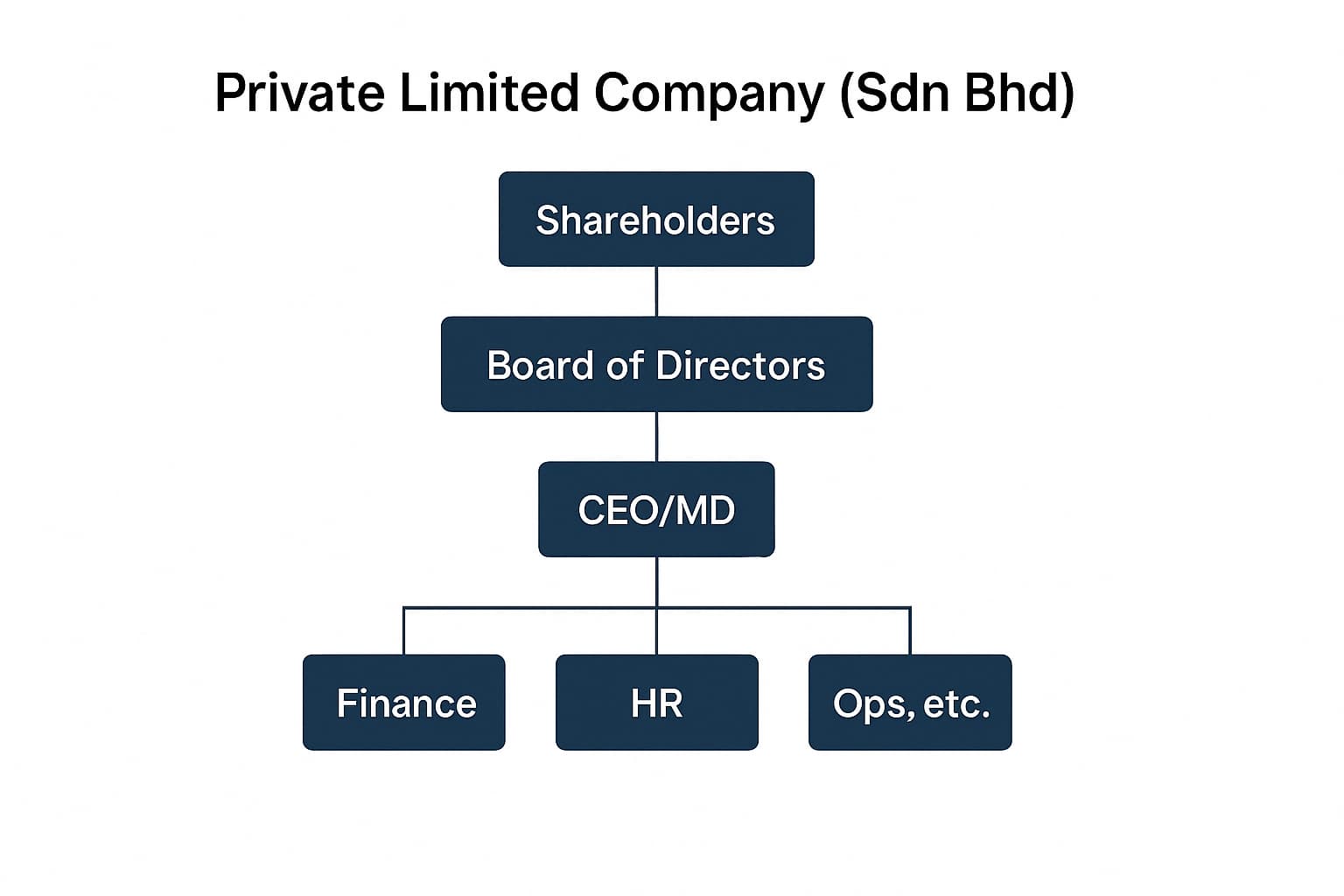

This is the go-to structure for most SMEs in Malaysia. When you register an Sdn Bhd, your company becomes its own legal entity.

That means it can own property, enter into contracts, and even get sued—but your personal assets are protected.

A Sdn Bhd must have at least one director who lives in Malaysia and a company secretary.

You also need to follow annual filing requirements with the Companies Commission of Malaysia (SSM), and your financial statements may need to be audited.

For business owners looking to grow, an Sdn Bhd offers better credibility, tax benefits, and the ability to raise funds.

It’s the natural next step for entrepreneurs who start out as sole proprietors and want to scale.

4. Public Limited Company (Berhad)

.jpg)

A Berhad company is much larger in scale. This is the structure used by companies planning to list on the stock exchange or raise money from the public.

It has stricter rules. You need a board of directors, you must publish financial reports, and you're accountable to shareholders.

Most SMEs don’t need this structure unless they plan to go public.

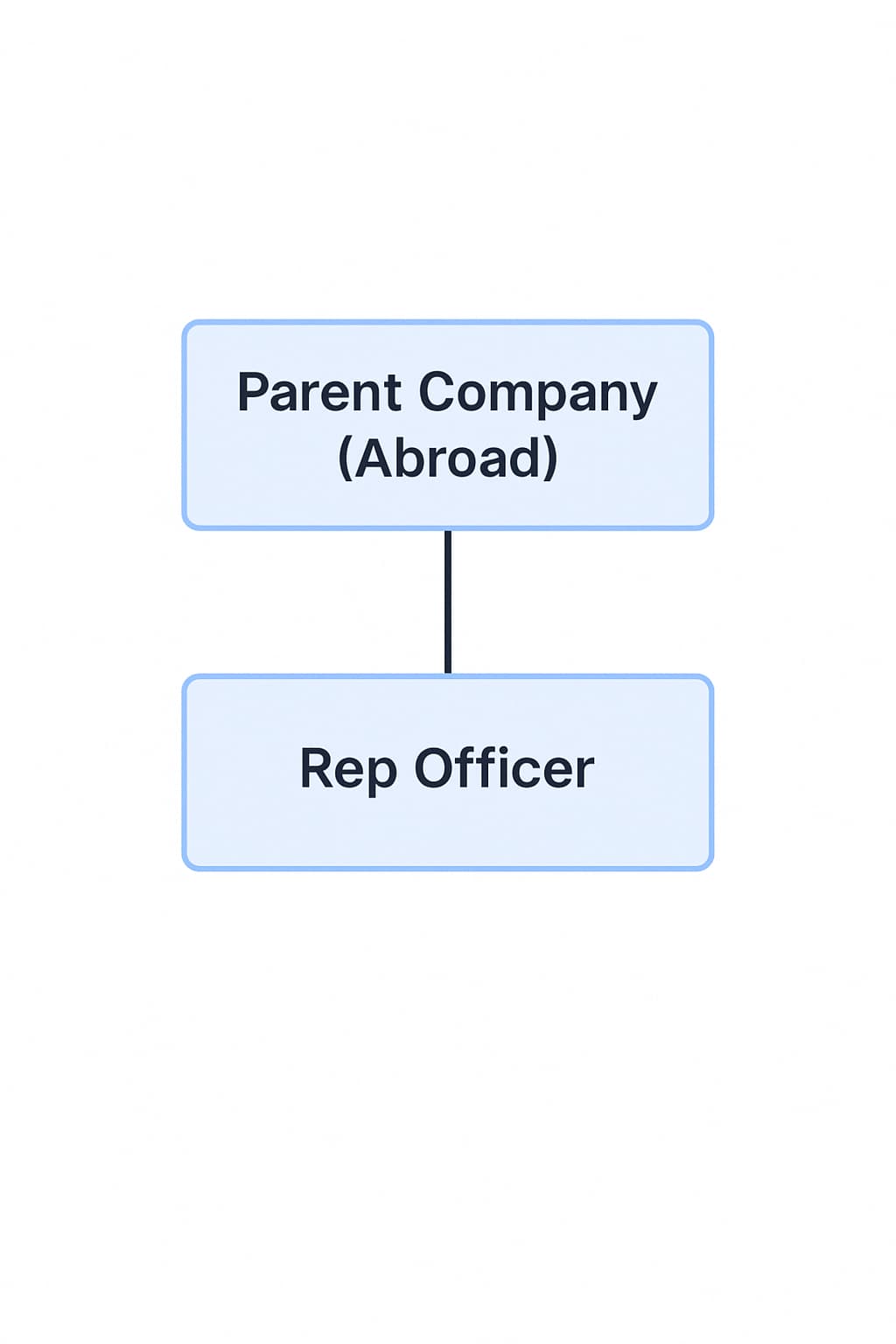

5. Foreign Company Branch/Representative Office

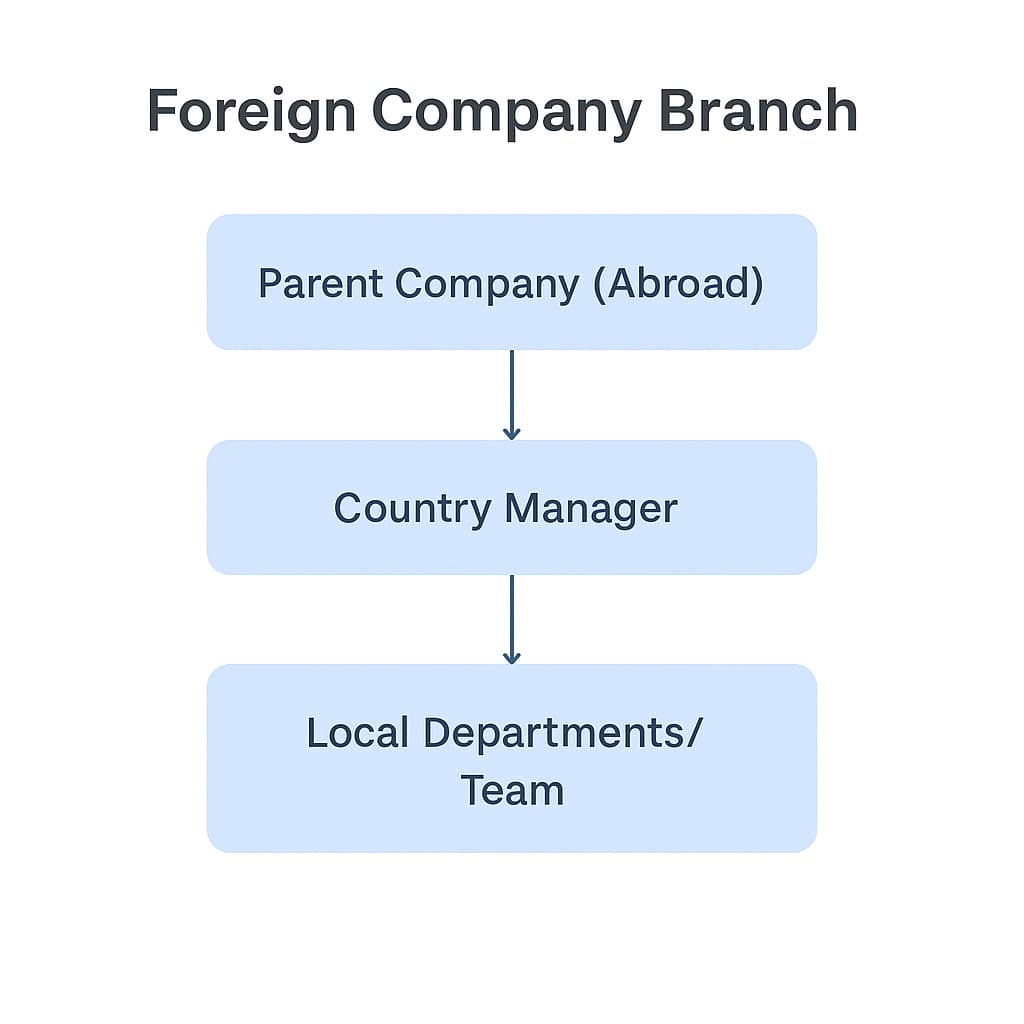

If you're a foreign investor looking to expand into Malaysia, you can open a branch office or set up a representative office.

-

A branch office is registered in Malaysia but operates as an extension of your foreign company. It’s allowed to conduct business and make profits.

-

A representative office, on the other hand, is more for research and networking. You can’t generate revenue or sign contracts locally.

Comparison & Differences of Business Structures in Table

As an employer, you’ll often need to compare different company structures side by side, especially when you're planning to register a business or restructure your current setup.

Each structure impacts how you handle taxes, ownership, compliance, and even day-to-day control over the business.

Below is a simple breakdown to help you see the key differences.

|

Feature |

Sole Proprietorship |

Partnership |

LLP |

Sdn Bhd (Private Ltd) |

Berhad (Public Ltd) |

Foreign Branch/Rep Office |

|---|---|---|---|---|---|---|

|

Capital Requirement |

Low |

Low |

Medium |

Moderate |

High |

Varies (based on setup) |

|

Taxation |

Personal income tax |

Personal income tax |

Taxed as a business entity |

Corporate tax |

Corporate tax |

Corporate tax (branch) / none (rep) |

|

Compliance Level |

Simple |

Simple |

Moderate |

High |

Very high |

Moderate to high |

|

Ownership & Control |

One person |

Two or more |

Two or more |

1–50 shareholders |

Unlimited shareholders |

Foreign HQ retains control |

|

Liability |

Unlimited |

Unlimited (Conventional) |

Limited (LLP) |

Limited |

Limited |

Limited (branch) / N/A (rep) |

How to Choose the Right Company Structure

Choosing the right company structure is like choosing the foundation for a building.

If it’s not the right fit from the start, you may face complications later, whether it's in tax reporting, liability, or business expansion.

The decision should be based on how you want your business to grow, how much control you want to keep, and how prepared you are to handle compliance.

1. Think about your business goals and scale

If you're running a small-scale operation with a few staff and want minimal paperwork, a sole proprietorship or partnership might be enough.

But if you’re planning to grow fast, seek external funding, or attract investors, a Sdn Bhd gives your business more structure and credibility.

2. Consider tax efficiency

Different structures mean different tax obligations.

For example, income from a sole proprietorship is taxed as personal income, which may push you into a higher tax bracket as your profit grows.

Meanwhile, a Sdn Bhd is taxed under corporate rates, which might be more efficient once your business reaches a certain size.

3. Assess ownership and liability needs

If you're concerned about risk, liability is a key factor. A sole proprietor or conventional partnership carries unlimited liability, meaning your personal assets could be at risk.

An Sdn Bhd or LLP, on the other hand, offers limited liability protection, so your personal finances are kept separate from business losses.

4. Think about future funding

Planning to pitch to investors or take a bank loan?

Most banks and investors prefer dealing with a Sdn Bhd or Berhad, because these structures offer better transparency, audited accounts, and a proper shareholder framework.

It gives external parties confidence in your business.

At the end of the day, the best structure is one that balances growth potential with control, cost, and legal protection.

Take time to map out where you see the business in the next few years and choose a structure that will support that journey, not limit it.

What If Business Wants to Change Company Structure?

As your business grows, your current structure might not be enough to support it anymore.

Many Malaysian businesses start out as sole proprietorships or partnerships and later shift to an Sdn Bhd once they scale up, attract investors, or take on bigger risks.

So, when is the right time to change your company structure?

Reasons for Restructuring

The most common reason is growth. A bigger business means more responsibility, such as financial, legal, and operational. You might need to restructure if:

-

You’re attracting more clients or entering into high-value contracts.

-

You’re seeking funding from banks or investors.

-

You want to reduce personal liability.

-

You’re expanding your team or planning to operate in multiple regions.

For example, as a sole proprietor, your business and personal finances are legally the same.

But as your revenue grows and risks increase, you may decide to convert to an Sdn Bhd for legal protection and credibility.

Steps to Convert from Sole Proprietor to Sdn Bhd

Here’s a basic process if you’re shifting from sole proprietor to Sdn Bhd:

-

Register the new Sdn Bhd with the Suruhanjaya Syarikat Malaysia (SSM).

-

Close your sole proprietorship at SSM once your Sdn Bhd is fully set up.

-

Transfer assets, contracts, and accounts from your old business to the new company. This includes bank accounts, licenses, and agreements.

-

Inform your clients, suppliers, and staff about the change. Update all invoices and business documents with the new company name and registration number.

Be mindful. Once you’ve set up an Sdn Bhd, you’ll need to maintain proper accounting, hold annual general meetings, submit annual returns, and possibly appoint a company secretary and auditor.

The compliance bar is higher, but so are the opportunities.

How to Register New Business in Malaysia Legally

When setting up or changing your company structure in Malaysia, there are important legal steps you need to follow.

This is especially true if you're moving towards more formal structures like Sdn Bhd or Berhad.

Everything starts with Suruhanjaya Syarikat Malaysia (SSM), also known as the Companies Commission of Malaysia.

SSM is the statutory body that regulates company and business registration in Malaysia.

Any formal business, whether it’s a sole proprietorship, partnership, or private limited company, must be registered with SSM.

They oversee the legal and compliance aspects of business formation, from approving names to monitoring annual filings.

The registration process varies based on your chosen structure:

For Sole Proprietorship or Partnership

-

Visit the SSM website or the nearest counter.

-

Provide a copy of your IC and business address.

-

Pay a registration fee, which typically ranges from RM30 to RM60.

-

You'll receive a Certificate of Registration, usually on the same day.

For Private Limited Company (Sdn Bhd)

-

Reserve your company name via the MyCoID system.

-

Hire a licensed company secretary (mandatory).

-

Submit the Super Form, which includes details like:

-

Company name

-

Business nature

-

Paid-up capital

-

Shareholder and director information

-

-

Wait for SSM approval. Once approved, your company will receive a Certificate of Incorporation.

-

Register for tax (LHDN), EPF, SOCSO, and possibly SST if applicable.

The registration fee for Sdn Bhd is RM1,000, not including professional fees for secretarial or setup services.

Documents You’ll Need

Depending on your structure, be ready with the following:

-

Identification documents (NRIC or passport)

-

Business or company address

-

Proposed company name

-

Shareholder and director details (for Sdn Bhd)

-

Declaration forms (Form 48A, Form 49, Constitution if applicable)

-

Consent letter from landlord (if using a rented business premise)

Common Mistakes When Choosing a Structure

Choosing the right company structure shapes how your business operates, how much tax you pay, and how protected you are legally.

Unfortunately, many business owners don’t think long-term when they make this decision. Here are some common mistakes employers should look out for:

Underestimating Compliance Obligations

One of the biggest mistakes is picking a structure without understanding the ongoing requirements.

For example, a sole proprietorship is simple to manage but offers no legal separation between the owner and the business.

Meanwhile, an Sdn Bhd structure comes with more protection, but also means more rules to follow, such as appointing a company secretary, submitting annual returns, and keeping financial records updated for audits.

Some employers register as a sole prop to “keep things simple,” but later find it difficult to scale or attract partners due to credibility issues or lack of governance.

Not Considering Tax Implications

Each structure is taxed differently. A sole proprietor’s business income is treated as personal income, which may push you into a higher tax bracket.

On the other hand, an Sdn Bhd pays corporate tax, which can be more efficient as profits increase.

Many employers miss this when they start. Later, they’re surprised when they’re unable to claim certain deductions or when their personal tax liability becomes overwhelming.

Delaying a Restructure When Business Grows

As your business grows, your structure should grow too.

Some employers wait too long to switch from sole proprietorship to Sdn Bhd, even after hiring multiple employees or generating large income.

By then, restructuring can be more complex due to legal, financial, and operational changes that have already taken place.

Being proactive in changing your company structure when the time is right helps avoid bigger headaches later on.

FAQ

Can I start as a sole proprietor and later change to Sdn Bhd?

Yes, and many business owners in Malaysia do this. A sole proprietorship is a good starting point because it’s simple and low-cost. But when your business grows, you might want to switch to a Private Limited Company (Sdn Bhd) for better protection and credibility. Just remember that converting your structure means setting up a new company and updating everything from your licenses to contracts.

What is the difference between LLP and Sdn Bhd?

LLP stands for Limited Liability Partnership. It combines features of a partnership and a company. It’s less formal than Sdn Bhd in terms of paperwork and audit, but still provides limited liability.

Sdn Bhd, on the other hand, has stricter compliance and reporting rules. It’s more suitable for businesses that plan to raise funds, bring in investors, or build a formal corporate structure.

Do all company structures require a business license?

Yes, regardless of your structure, you still need to register your business and apply for the right licenses depending on your activity. Local councils (PBTs) and industry bodies may have specific requirements. Having a registered company alone doesn’t mean you can skip licensing.

Which structure is suitable for a startup with investors?

If you’re planning to bring in investors or raise capital, the best option is usually Sdn Bhd. It’s the most recognized structure for fundraising in Malaysia. It has clear rules for shareholding, directorship, and dividends, which gives investors confidence. LLPs and sole proprietorships don’t have the same flexibility when it comes to investment.

Is it mandatory to audit accounts for all structures?

No. Only certain structures like Sdn Bhd and Berhad are required to submit audited financial statements. Sole proprietors, partnerships, and LLPs (under certain conditions) are exempt from audit, though they still need to file tax returns. However, even if not required, some businesses still prepare audited accounts for credibility, especially when applying for loans or pitching to partners.

Your Next Great Hire Could Be One Click Away

Finding skilled, committed workers doesn’t have to be difficult.

AJobThing connects you with the right people, whether local or foreign, who are ready to work and grow with your business.

Post your job today and build a team that supports your mission and values. Let’s make your workplace stronger, together.

Read More:

- What is Inland Revenue Board of Malaysia (LDHN)?

- How Malaysia’s New 2025 Global Tax Rules Will Impact Your Business

- Total Tax Exempt Allowances, Perquisites, Gifts & Benefits in Malaysia (2025)

- TP1, TP2, and TP3 Forms Malaysia: Definition, Requirements, Free Download Form

- CP22 Form: Deadline, Free Download, & How to Fill

- CP204: Deadline, Calculation, & Free Download Form

- How to Use ByrHASiL for Online Tax Payments in Malaysia

- PCB Deduction in Malaysia: Calculation, Rates & Employer Guide

- What is the 182 Days Rule in Malaysia? Tax Residency Explained

- Labour Law Malaysia Salary Payment For Employers

- Calculate Take-Home Salary in Malaysia (With Examples)

- Tax Borne by Employers: What is it and How to Calculate

- How to Check Income Tax for Employers in Malaysia

- B40, M40, and T20 Salary Range in Malaysia (2025 Update)

- Malaysia Salary Tax Rate 2025 (YA 2024): How to Calculate, Tax Bracket

- Salary Slip Malaysia: Format, Sample, and Free Download