How to Prepare a Monthly Salary Report in Malaysia (+ Free Templates)

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowPayroll errors can be costly. Whether it’s underpaying, overpaying, or missing a deduction, even small mistakes can lead to bigger problems.

One way to reduce that risk is by having a clear monthly salary report. It helps employers double-check every detail before payroll goes out.

In this article, we’ll walk you through what a monthly salary report is, what it includes, how to prepare one, and why it matters to you as an employer in Malaysia.

What is a Monthly Salary Report?

A Monthly Salary Report is a document that summarises everything related to employee salary payments for a specific month.

It shows how much each employee earns, what benefits they receive, what deductions are made, and the final amount they take home.

This report plays a big role in managing payroll smoothly. It helps keep track of expenses, plan company budgets, and follow Malaysian labour laws.

If you’re ever audited by authorities or need to check a salary dispute, this report becomes a reliable reference.

The responsibility of preparing this report usually falls under the HR, Finance, or Payroll Department, depending on your company’s structure.

In smaller companies, one person might handle everything, while in larger firms, it’s often a collaborative task between teams.

Key Components of a Monthly Salary Report

A salary report is more than just a payslip. It includes a breakdown of several important elements:

Employee Details

Each entry usually begins with the employee's name, ID, department, and position. This information helps identify the right person and organise the report properly.

Basic Salary

This refers to the fixed amount an employee earns before adding allowances or deducting anything.

Some employees are paid monthly, others by the hour, and a few might work on a commission basis.

All of these are covered in the basic salary section.

Allowances and Benefits

Many companies give extra payments to support employees, such as meal allowances, travel reimbursements, housing allowances, or overtime pay.

These need to be recorded clearly so there’s no confusion later.

Deductions

Employers must follow rules for statutory deductions.

This includes EPF (Employees Provident Fund), SOCSO (Social Security), EIS (Employment Insurance System), and PCB (monthly tax deduction).

If an employee has loans, insurance, or any advance payments, those deductions also go into this section.

Bonuses and Incentives

Any extra payments like performance bonuses, festive season bonuses, or commissions should be shown separately.

So, employees can understand what part of their salary is fixed and what part depends on performance.

Net Pay Calculation

Finally, the report shows the net salary, which is the actual amount the employee receives after all additions and deductions.

This part is especially important because it shows transparency in how the final figure is calculated.

How to Prepare a Monthly Salary Report?

Creating a Monthly Salary Report doesn’t have to be stressful. Whether you run a small team or manage a large workforce, the steps below can guide you:

1. Choose Your Payroll System

First, decide how you want to manage payroll. Some companies still use manual methods like spreadsheets, while others invest in payroll software.

For small businesses, using Excel templates can work.

But as your team grows, it might be better to use tools like SQL Payroll, Kakitangan, or PayrollPanda, all of which are popular in Malaysia.

2. Gather Payroll Data

Next, collect all relevant data: working days, leave records, overtime hours, bonuses, deductions, and so on. This data needs to be accurate to avoid confusion or mistakes.

3. Follow Statutory Compliance

Make sure all necessary deductions are made based on Malaysian law. EPF, SOCSO, and EIS have fixed contribution rates.

Also, don’t forget to calculate PCB based on the LHDN schedule.

4. Generate and Review the Report

Once the data is entered, generate the salary report. Before finalising, review it to spot any errors or mismatches.

It’s best to double-check before salaries are paid out. Fixing errors after payment can cause unnecessary problems.

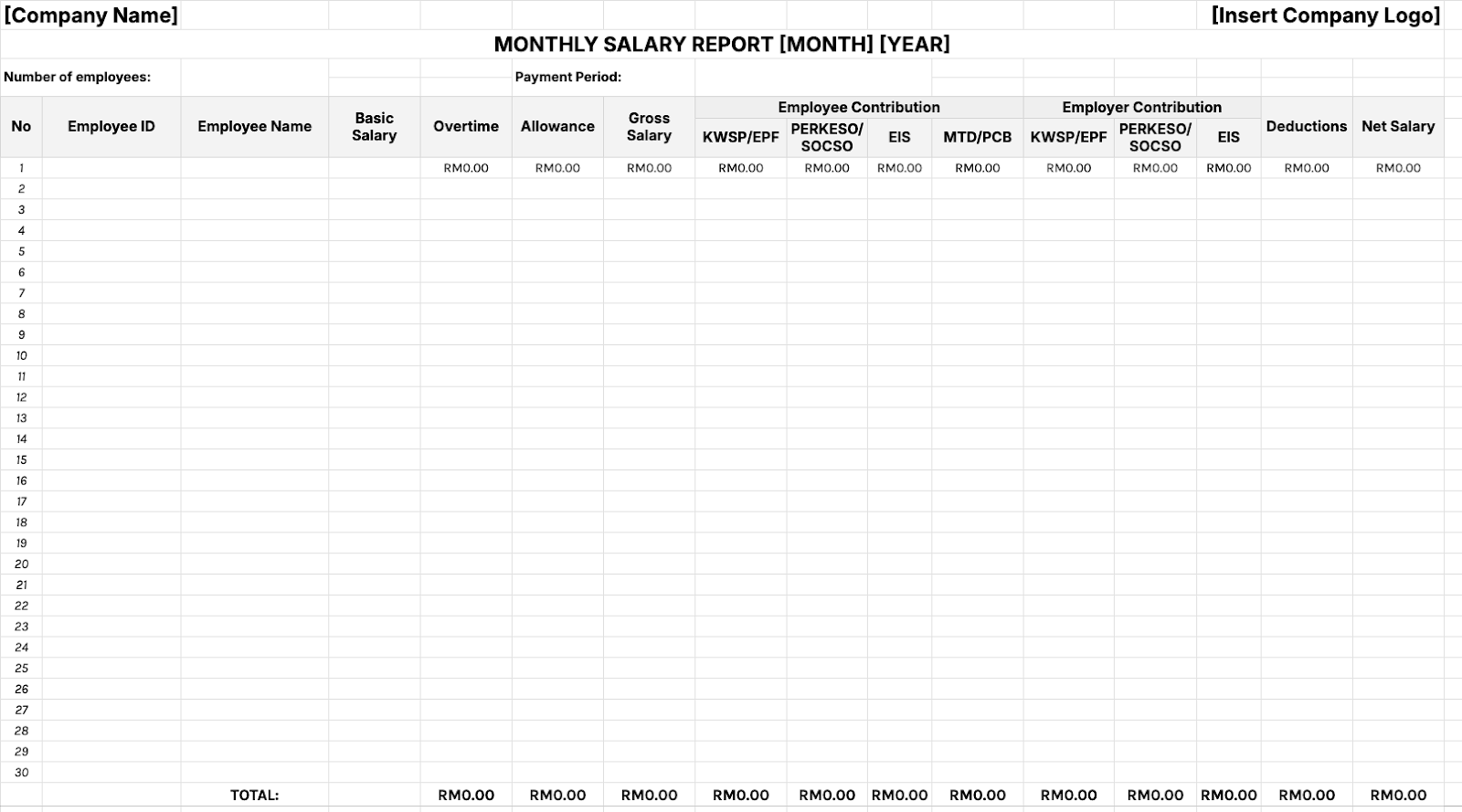

5 Monthly Salary Report Format and FREE Excel Templates

There’s no one-size-fits-all design, but most reports follow a clean and clear structure. A typical salary report might include:

-

Employee Information (Name, ID, Department)

-

Salary Components (Basic, Allowances, Bonuses)

-

Statutory Deductions (EPF, SOCSO, EIS, PCB)

-

Other Deductions (Loans, Advance Payments)

-

Net Pay

Many employers prefer using Excel templates because they’re flexible and easy to customise.

Others use built-in features from their accounting or payroll software, which often auto-calculate salaries and generate reports with one click.

Make sure the format is easy to read and structured in a way that any stakeholder (HR, Finance, or even the employee) can understand it without confusion.

Below are 5 templates that you can use in your company. You can adjust these based on your company's needs.

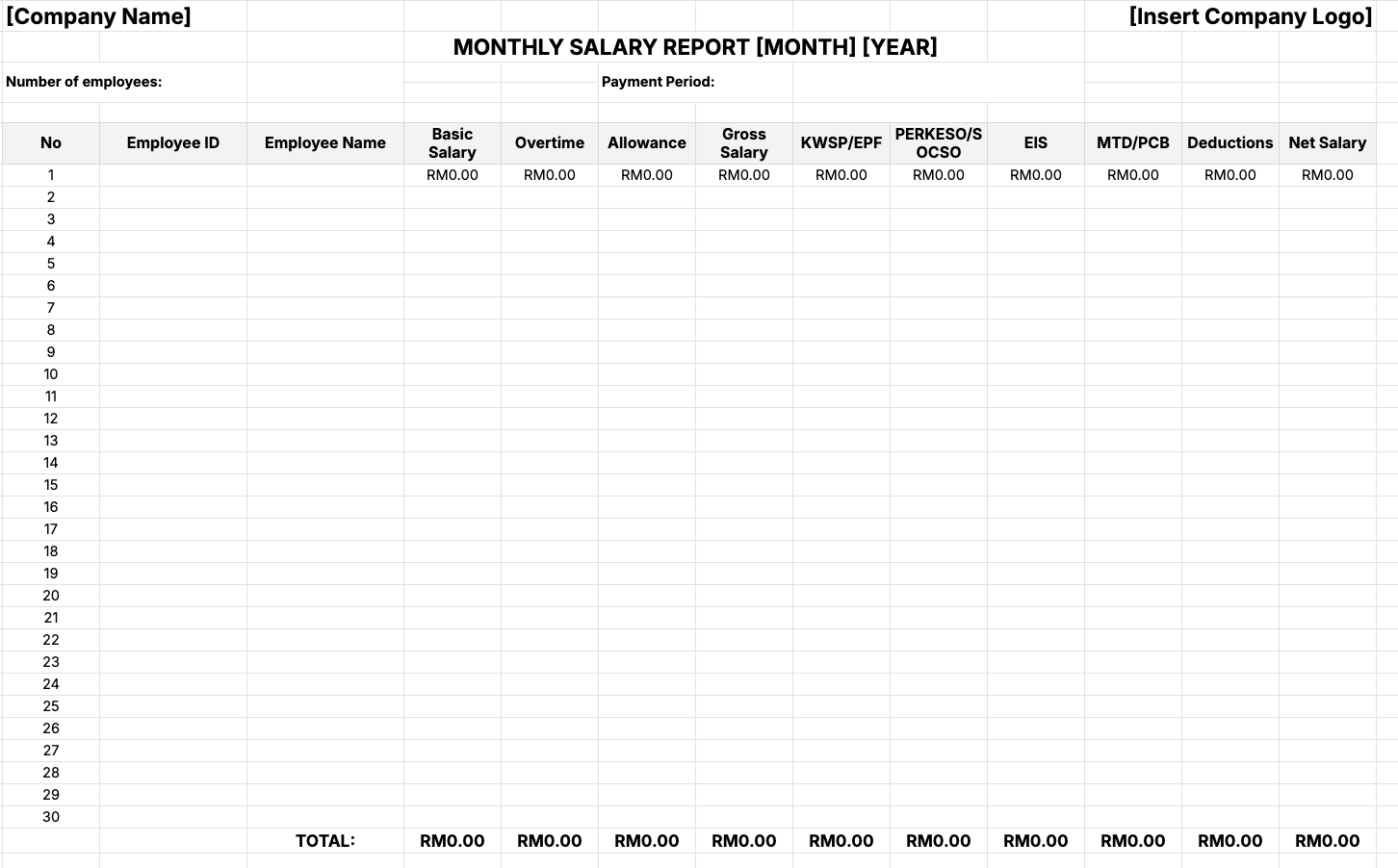

1. Monthly Salary Report Template 1

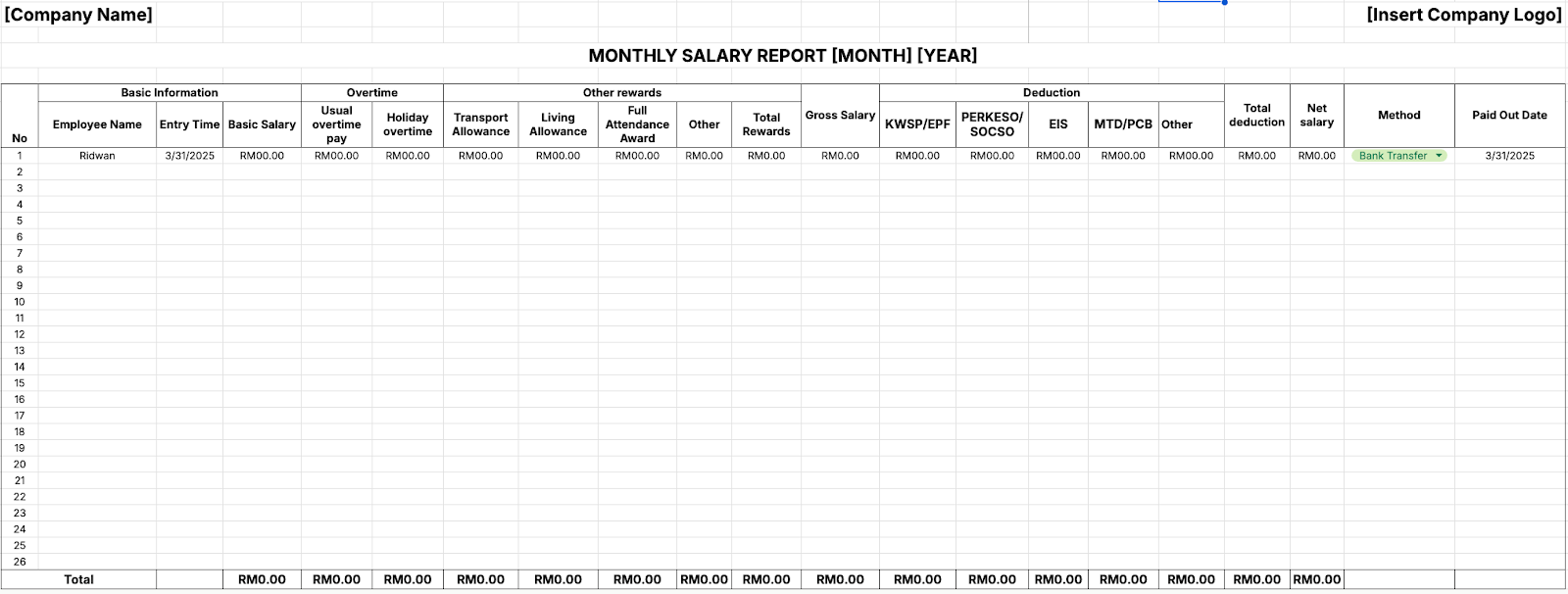

2. Monthly Salary Report Template 2

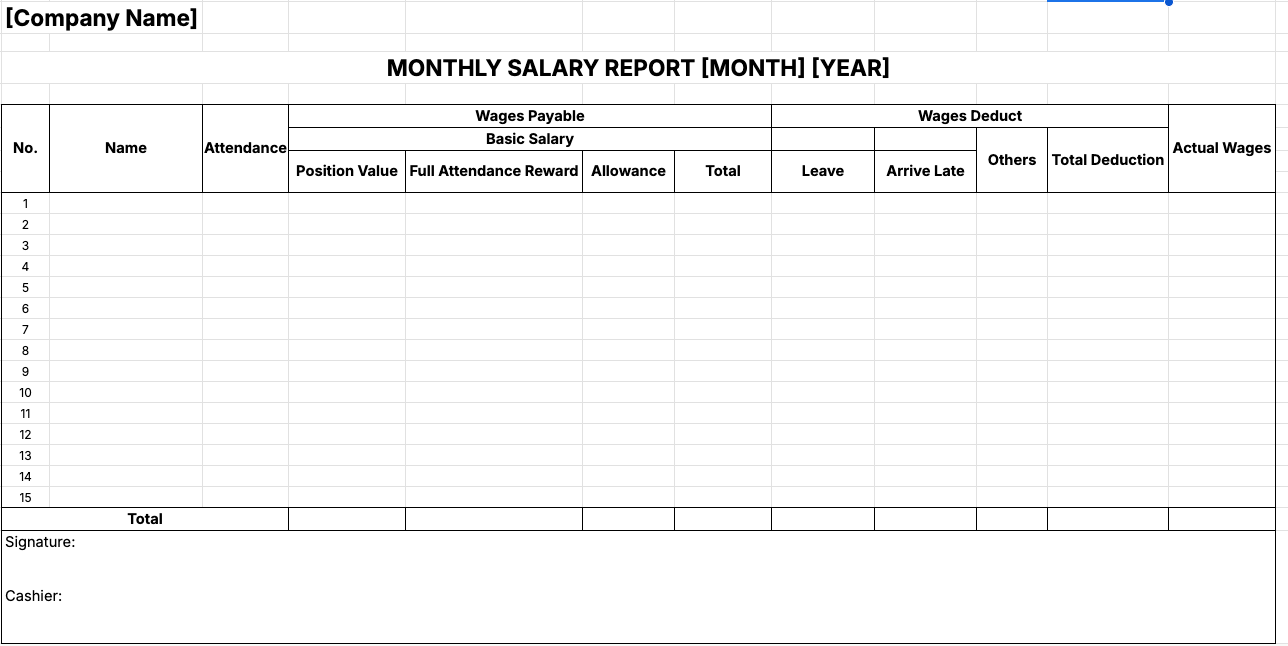

3. Monthly Salary Report Template 3

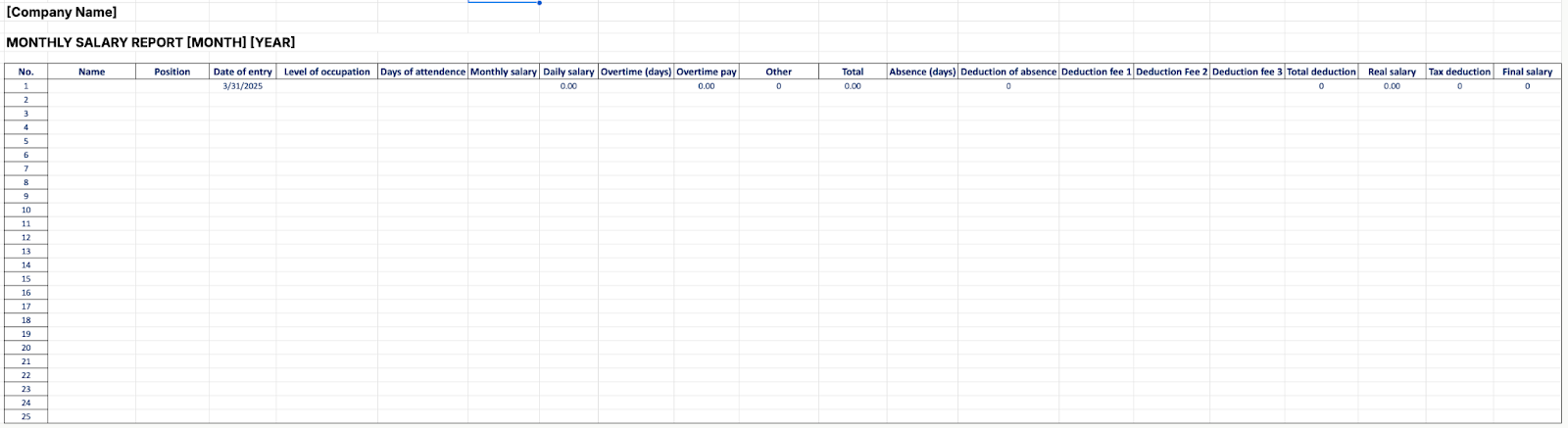

4. Monthly Salary Report Excel Template 4

5. Simple Monthly Salary Report Template 5

FAQ

Why is a monthly salary report important for employers?

It helps employers stay organised, control payroll costs, and follow legal obligations. It’s also useful for audits, tax filing, and internal reviews.

What software can I use to generate a salary report?

Some popular options in Malaysia include PayrollPanda, Kakitangan, and SQL Payroll. For smaller businesses, Excel templates from WPS or other free platforms might be enough.

What should I do if there is a payroll error in the report?

Fix the error as soon as it’s found and communicate clearly with the affected employee. Also, update the corrected version in your records to avoid future issues.

How long should I keep salary reports for record-keeping?

It’s recommended to keep salary reports for at least 7 years, as required under Malaysian law for company and tax records.

How does the salary report impact tax filing?

The Monthly Salary Report provides detailed records for tax reporting, especially for PCB and annual EA Form preparation. It supports accurate tax submission to LHDN.

Need to hire the right talent?

If you’re hiring, post your jobs on Maukerja or Ricebowl—with over 6 million jobseekers in Malaysia, your next top talent is waiting!

Read More:

- Jadual Caruman PERKESO 2025 | SOCSO Contribution Schedule & Rates

- What is Sistem Insurans Pekerjaan (SIP)? A Complete Guide

- How to Handle a Retirement Letter to Employer

- How to Handle Resignation Letter for Employers

- 10 Exit Interview Questions to Ask Employees

- Tips for Interviewer: How to Prepare and Conduct a Virtual Interview

- Key Performance Indicator (KPI): Definition, Types, Dashboard, Criteria and Examples

- How to Handle Quiet Quitting in Malaysia

- How to Check Income Tax for Employers in Malaysia

- What Are Statutory Deductions? Definition, Types, Example

- Calculate Take-Home Salary in Malaysia (With Examples)

- Tax Borne by Employers: What is it and How to Calculate

- How to Check Income Tax for Employers in Malaysia