STR 2025 (Sumbangan Tunai Rahmah): Eligibility, Payment Dates & How to Apply

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowIn 2025, the Malaysian government has allocated RM13 billion to support nearly 9 million citizens through Sumbangan Tunai Rahmah (STR 2025).

This initiative, part of the larger Bantuan Rahmah programme, focuses on easing the financial burden of B40 and M40 groups, especially households with children, single individuals, and senior citizens.

While this is mainly a government programme, employers and HR teams still have a role to play. Why?

Because financial stress affects employee wellbeing and productivity. STR 2025, although not workplace-based, can impact your employees' household income and their morale.

This article helps employers understand what STR 2025 is, how it works, and how to guide employees through it.

What is Sumbangan Tunai Rahmah (STR)?

Sumbangan Tunai Rahmah, or STR, is a direct cash aid programme under Malaysia’s Bantuan Rahmah umbrella.

It’s designed to support low and middle-income groups (B40 and M40) by easing the impact of rising living costs.

STR 2025 continues the legacy of previous programmes like Bantuan Sara Hidup (BSH) and Bantuan Prihatin Rakyat (BPR), but with expanded support and higher payouts.

This year, STR 2025 offers the largest aid amount so far, with payments reaching up to RM4,600 per household.

The assistance is structured to reach those most in need, such as families with multiple dependents, single seniors, and individuals earning lower incomes.

Est 9 Million Recipients Total RM13 Bilion for STR 2025

Under Budget 2025, the Malaysian government has increased the total allocation for STR 2025 and its related initiative, Sumbangan Asas Rahmah (SARA), to RM13 billion.

This budget is expected to benefit around 9 million recipients, roughly 60% of Malaysia’s adult population.

The aid amount depends on several factors: monthly household income, number of children, marital status, and whether the applicant is a senior citizen or single.

Here’s a simplified breakdown of the cash support for 2025:

-

Households earning RM2,500 and below can receive between RM1,000 to RM2,500, depending on the number of children.

-

Households earning RM2,501 to RM5,000 are eligible for RM500 to RM1,250.

-

Senior citizens without partners (aged 60 and above) with an income below RM5,000 will receive RM600.

-

Single individuals earning RM2,500 or less will also receive RM600.

The payments will be made in phases across the year, starting with Phase 1 in January 2025, followed by other phases around festive seasons like Aidilfitri.

This staged approach gives consistent relief rather than a one-time lump sum.

Who is Eligible for STR 2025?

There are three main eligibility groups:

1. Household (Isi Rumah)

Including married couples or single parents with children. To qualify, the total household income must be RM5,000 or below.

2. Senior Citizens Without Spouse (Warga Emas Tiada Pasangan)

This group includes individuals aged 60 and above, living alone or as single parents with no dependent children. Their income must also be RM5,000 or below.

3. Single Individuals (Bujang)

Single adults aged 21 to 59 and persons with disabilities (OKU) aged 19 and above, as long as they are not full-time university students. Their income must be RM2,500 or less.

Foreign spouses of Malaysian citizens may apply under household categories, as long as they meet the income criteria and provide supporting documents.

How to Apply or Check STR 2025 Eligibility

If any of your employees are unsure whether they qualify for STR2025, the application and checking process is simple and fully accessible online.

As an employer, you don’t need to apply on their behalf, but you can definitely help by guiding them through the steps or sharing this information in your internal HR communications.

To check eligibility or apply for STR2025, here’s how it works:

1. Use the MySTR Portal

Employees can go to the official STR website at https://bantuantunai.hasil.gov.my.

From there, they should click on the “Log Masuk MySTR” button and then select “Semakan Status” to check their current application or payment details.

2. Update Information If Needed

If their household or income information has changed, they can update it online through the same portal.

This includes adding or editing bank account details, dependent information, or marital status.

Applicants are encouraged to update their info at least once every three years, or whenever there’s a significant life change.

3. Apply In Person (if necessary)

For employees who are not comfortable applying online or lack access to the internet, they can submit their application manually at any LHDN office nationwide.

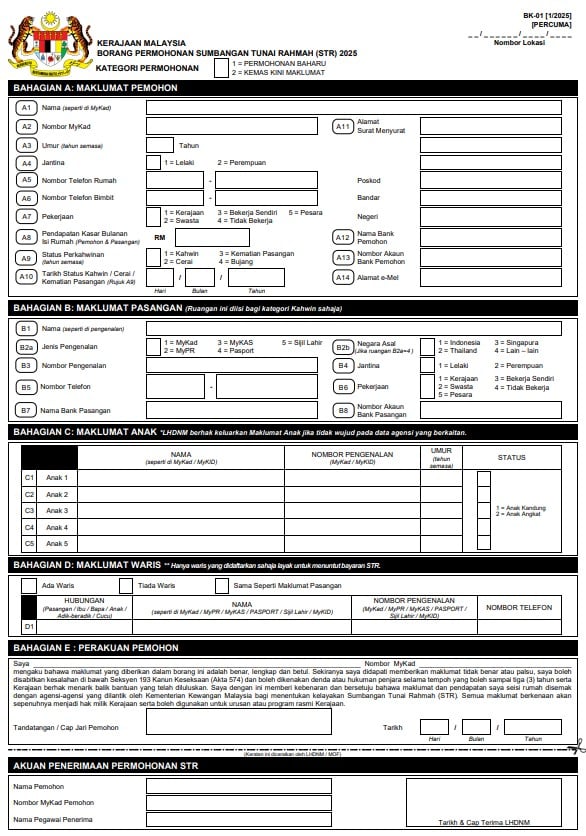

The STR form is also available for download on the portal.

For first-time applicants, the key things to prepare are:

-

A copy of the MyKad

-

Proof of income

-

Marriage certificate (if applying as a household)

-

Child’s birth certificate (if applicable)

Let your employees know that the application window for STR2025 is open all year, and they can apply or update their info anytime.

You can even provide a short tutorial during lunch breaks or include a guide in your HR newsletter.

STR 2025 Payment Schedule Date

The first phase of STR payment started on 22 January 2025, and it was rolled out in stages.

Phase 2 payments are scheduled to be made starting March 24, 2025.

Phase 3 payments are anticipated to be made in August 2025.

Finally, Phase 4 payments are expected to be made in November 2025.

As for payment methods, there are two main options:

1. Direct bank transfer

The default method if the applicant has submitted valid bank account details. The funds will be credited straight into the recipient's bank account.

2. Cash payment via BSN

For recipients without a bank account, the payment can be collected at any Bank Simpanan Nasional (BSN) branch. Employees just need to bring their MyKad for verification.

From the HR side, you don’t need to manage or facilitate the payment directly. But what you can do is:

-

Remind employees when a new phase is coming up.

-

Help them check the status online (especially those who are less tech-savvy).

-

Advise them to keep their bank information updated on the MySTR portal to avoid delays.

A quick heads-up in your staff group chat or weekly email can go a long way to keep everyone informed.

STR 2025 vs Previous STR Initiatives

If your employees are familiar with older names like BSH (Bantuan Sara Hidup) or BPR (Bantuan Prihatin Rakyat), it’s because STR is essentially the next version of these same government assistance programmes.

STR stands for Sumbangan Tunai Rahmah, and since its introduction, it has gone through several improvements to better reach those in need.

Compared to STR 2024, STR 2025 has introduced several notable upgrades:

Higher payout amounts

For example, households with five or more children can receive up to RM2,500 compared to the previous RM2,300 in STR2024.

Single individuals now receive RM600, which is more than in earlier years.

Expanded eligibility

More categories are being recognised, including additional support for single parents, senior citizens without partners, and low-income households.

Bigger budget allocation

The government has increased the total budget for STR2025 to RM13 billion, covering nearly 9 million recipients, which makes up around 60% of the adult population in Malaysia.

While the intention behind all versions (BSH, BPR, and STR) has always been to provide direct cash assistance.

STR2025 focuses more sharply on cost-of-living pressures and targets financial aid to where it’s needed most.

What Should Employers Know About STR?

As an employer or HR professional, you might wonder how STR2025 fits into your workplace.

While it's not a company-run programme, it directly affects your employees’ household income, especially those in the B40 and M40 categories.

1. Improves financial well-being

If some of your staff fall under STR 2025 eligibility, the additional support can help reduce financial stress.

This may indirectly lead to better focus at work, improved morale, and fewer distractions caused by money-related worries.

2. Supports retention of low-income employees

STR 2025 plays a role in helping your lower-income employees manage cost of living.

When workers feel that external support is available and their employer is aware of it, they are more likely to feel seen and valued—this builds loyalty.

3. It’s a communication opportunity for HR

You don’t need to be involved in the application process.

But you can help by sharing accurate information, such as the payment phases, how to check status, and where to update personal details.

Clear HR communication prevents confusion and reduces dependency on hearsay.

4. It reflects positively on your company culture

When you take a moment to acknowledge national aid like STR 2025, it shows that your company keeps up with real issues faced by employees.

That kind of awareness can strengthen trust between your company and its workforce.

FAQ

Is STR taxable?

No. STR 2025 is classified as government financial aid and is not subject to income tax. Employees who receive it do not need to report it in their annual tax filing.

Can employers help employees check STR status?

Yes, but only by guiding them. You can direct employees to the official portal https://bantuantunai.hasil.gov.my where they can log in using their MyKad and personal details. For privacy reasons, it’s best that employees handle the actual log-in and application themselves.

What happens if an employee’s STR is rejected?

If an employee receives a “Tidak Lulus” status, they can submit an appeal during the official appeal period. The reasons for rejection and necessary supporting documents will be stated in the system. You can encourage employees to read the FAQ at the portal and prepare the right documents to reapply.

Where can I download STR 2025 forms?

Forms can be downloaded from the STR portal here. Employees can also walk into the nearest LHDN branch for manual form submission or updates, especially if they lack internet access.

Are you struggling to attract top talent to your company?

The right incentives can make all the difference! Offering competitive benefits and rewards not only motivates your team but also attracts the best candidates.

If you're looking to hire new employees who are passionate, driven, and ready to contribute to your company's success, now is the time to post your job openings.

Start building a strong, motivated team today by offering the right incentives! Post your job now and watch your team thrive.

Read More:

- What Is Incentive? Definition, Types, and Examples for Employers

- Malaysia Faces 24% US Tariff: Rates & How It Affects Busineses

- How Malaysia’s New 2025 Global Tax Rules Will Impact Your Business

- Total Tax Exempt Allowances, Perquisites, Gifts & Benefits in Malaysia (2025)

- TP1, TP2, and TP3 Forms Malaysia: Definition, Requirements, Free Download Form

- CP22 Form: Deadline, Free Download, & How to Fill

- CP204: Deadline, Calculation, & Free Download Form

- How to Use ByrHASiL for Online Tax Payments in Malaysia

- PCB Deduction in Malaysia: Calculation, Rates & Employer Guide

- What is the 182 Days Rule in Malaysia? Tax Residency Explained

- Labour Law Malaysia Salary Payment For Employers

- Calculate Take-Home Salary in Malaysia (With Examples)

- Tax Borne by Employers: What is it and How to Calculate